Will Overzealous Regulators Make Your Smartphone Stupid?

The authors of this paper discuss the patent system’s integral role in a flourishing innovation economy and argue that recent actions in this system by antitrust authorities have had “a deleterious effect on high-tech innovation in the spaces of standards and patent licensing,” and on innovation in general.

Contributors

Adam Mossoff

Kristen Osenga

Hon. Randall Rader

Mark Schultz

Robert Stien

This paper was the work of multiple authors. No assumption should be made that any or all of the views expressed are held by any individual author. In addition, the views expressed are those of the authors in their personal capacities and not in their official/professional capacities.

To cite this paper: Adam Mossoff, et al. “Will Overzealous Regulators Make Your Smartphone Stupid?”, released by the Regulatory Transparency Project of the Federalist Society, December 10, 2018 (https://rtp.fedsoc.org/wp-content/uploads/IP-Paper-Patent-Licensing.pdf).

Introduction

We live in an extraordinary time. No area of our lives is untouched by remarkable innovations in technology. The revolution in digital technology that first began in the mid-twentieth century has changed how we live, work, and play. We navigate using GPS-enabled map services on “smartphones” (really micro-computers) in our pockets; we instantly communicate with family, friends, and colleagues anywhere in the world; we enjoy computer-operated coffee machines, refrigerators that create grocery lists, and remotely programmable home heating and cooling systems; and we entertain ourselves with programming accessible almost anywhere, any time, and on any number of devices. Innovation makes our lives easier, more productive, and more fun.

Unfortunately, the benefits of all this innovation is threatened by overzealous regulation by government bureaucrats. While some regulation is necessary and plays a laudable role in society, it is becoming increasingly intrusive, and is hindering innovation. Specifically, interference in the patent system is deterring innovative enterprises from doing what they do best—creating new and ever more useful products for us to use and enjoy.

To understand how overregulation is hindering innovation, it is important to understand the relationship between innovation and the patent system. Inventing is expensive and time-consuming, regardless whether we’re talking about the next generation of smartphone, new diagnostic equipment that enables early-stage detection while disease is still curable, or some new device none of us can yet imagine. Inventing is also risky. For every technological advance that shows promise, many more fail; and even successful inventions may not prove popular with consumers. For an innovating company to spend millions, or even billions, of dollars on research and development (R&D) to create these inventions, the company has to believe that it will recoup its expenses and earn enough profit from the few successful inventions to fund ongoing R&D to create more innovation.

Companies working in the innovation industries justify R&D expenditures and assumption of associated risk on their ability to obtain reliable and effective property rights in the fruits of their inventive labors. These property rights include patent protection, which secures to the inventor the right to exclude others from practicing an invention for a limited time, in exchange for making it known to the public (and allowing it to enter the public domain at the end of the patent term). The idea that an inventor possesses a property right in her invention has long been recognized in America as mutually beneficial to both the individual inventor and to the public.1 The same principle applies to all property; for example, farmers till the soil and husband crops for many months based on the promise of property rights in the output, which benefits everyone with increased food. This same commonsensical idea, securing reliable property rights in the output of inventive activity, underlies the patent system.

Unfortunately, regulatory overreach in the past decade has diminished the patent property right and has called into question the value and enforceability of these rights. The evidence is growing that the U.S. no longer has what was once known as the “gold standard” patent system. For example, for the past two years in a row, the United States has fallen from its perennial first-place position in a prominent annual ranking of world patent systems by the U.S. Chamber of Commerce. After falling from first place to tenth last year, the U.S. patent system is now ranked twelfth in the world, tied with Italy and behind Ireland, France, Spain, and Singapore, among others.2 China, a country many people think of as characterized by intellectual property (IP) theft has risen rapidly in that same ranking, and now stands at twentieth in the world in the quality and stability of its patent system—a mere eight places behind the U.S. ranking. It is especially disconcerting that, as rapidly as the U.S. is dropping, China is rising. We are losing our innovative edge, and it is directly attributable to the weakening of our patent system.

Although the evidence for and impact of a weakened patent system can be seen in many areas in the innovation economy, this paper focuses specifically on regulatory interference under antitrust laws. Bureaucrats in various government agencies, such as the Federal Trade Commission (FTC) have abused their authority to diminish innovation-oriented property rights. They have done this by seeking to substitute their views for the R&D decisions, business judgments, and market forces that would otherwise permit commercial enterprises to bring us beneficial new products and services in the marketplace. What is worse is that regulatory officials have not been merely substituting their views for the business and legal judgments of innovators, they have been choosing among those they believe should be winners or losers in the innovation economy on the basis of theories that are either unproven or directly contradicted by the evidence of rigorous economic studies.

Where are these theories coming from? They have been advanced in Washington, D.C. by vested interests who would directly benefit from regulatory interference, and an overall diminishment in the health and vitality of our patent system. Specifically, these interests have promoted laws and regulations that would hamper their competitors and undermine the business models of their competitors or suppliers who sell them the patented technology they use in their own products or services. In essence, they have lobbied for action, under the antitrust laws, against innovators in order to gain access to this technology at below-market prices or at government-set prices, and thereby avoid paying innovators for the investment and risk they assumed in developing those inventions.

This paper will explain the damage done to the innovation economy by burdensome and ill-conceived antitrust regulation and enforcement. First, this paper will briefly describe the patent laws and antitrust laws, as these are the two legal systems central to the recent damage done to the innovation economy. Second, the paper explains two areas of high-tech innovation that have been negatively affected by meddling by antitrust authorities in the innovation economy—technological standards and patent licensing. Third, the paper discusses past regulatory actions by FTC officials that had a deleterious effect on high-tech innovation in the spaces of standards and patent licensing, as well as how these actions hinder innovation.

I. Basics of Patent Law and Antitrust Law

Though perhaps not immediately obvious, there is a fundamental connection between patent law and antitrust law. The relationship between a patent system that incentivizes new innovation by providing reliable and effective property rights in inventions is more obvious and well established. What many are unaware of is the inherent tension between patent law and antitrust law, and how antitrust law can be used to undermine innovation.

A. Patent Law

A patent is a property right in a new invention. It secures to an inventor an exclusive right in all uses of this invention, excluding others from making, using or selling it without permission. These property rights are not granted willy-nilly. Federal law requires that the inventor must draft a detailed patent application that describes the invention, and which informs others how to make it and use the invention. The application is then examined by the United States Patent and Trademark Office (USPTO) to determine whether the invention is useful, new, and non-obvious and to ensure that the application adequately describes it. Beyond the expense and uncertainty that are a part of the inventive process, obtaining a patent on a new invention is also an expensive and uncertain endeavor.

When a patent is granted, the inventor has property rights in the invention. These property rights help the inventor recoup R&D expenditures, and justify the resources spent during the inventive process. There are many different ways an inventor may do this, just like an owner of real property has a number of options on how to most profitably use or develop one’s land. A landowner, for example, may live on the land in a home, become a landlord and lease a building on it to tenants, hold onto the land merely as a long-term investment like a real-estate developer, or sell the land to a company which might build a factory, a commercial store, or use it for some other useful purpose. Similarly, a patent owner might choose to manufacture and sell the consumer products that incorporate its technological innovation, as Ford Motor Company, Intel Corporation, or Eli Lilly & Company have done. Other patent owners choose to become the equivalent of landlords or real-estate developers, giving other people rights to manufacture, sell, or otherwise use their property—this is “patent licensing.” A common example today is Apple Computer, whose smartphones, tablets, and desktop computers are sold to consumers in boxes that proudly declare that they are “designed by Apple in California.” The operative word is designed, as these consumer products are in fact manufactured by Chinese companies by permission and under patent license agreements with Apple.3 Even many of Apple’s “designs” are invented by others from whom Apple either purchased the patent or to whom Apple pays a licensing fee. Historically, many of the great innovators about whom we learned in school, such as Thomas Edison, Nikola Tesla, Alexander Graham Bell, Samuel Morse, and Charles Goodyear, to name a few, profited from their productive labors by licensing their patent rights to industrialists and businesspersons.4

The property rights that are provided by a patent are a significant reason that we enjoy the extraordinary levels of innovation we see in America today. Patented inventions lie at the heart of nearly all of the products and services that are part of everyday life, as well as at the heart of the U.S. economy. Overwhelming economic and historical studies confirm that vibrant and flourishing societies all provide reliable patent protection to innovators.5

B. Antitrust Law and Policy

Antitrust laws are intended to protect consumers and promote competition in the marketplace.

They are designed to promote a level playing field, as readily accessible to new entrants as to established incumbents. Much antitrust analysis today is based on economics, and the laws are designed to promote overall consumer welfare and economic efficiency. The issue, however, is not as simple as making sure that companies do not charge unfairly “high” prices. Merit-based competition, such as offering better quality goods, improved service, or other innovations in exchange for higher prices is not anticompetitive. Rather, it produces the exact type of marketplace we want—with a variety of goods and services being offered at a range of price points, and competition among producers to develop newer or better products.

Although antitrust law and patent law both promote innovation by encouraging producers to develop new products and services, antitrust has long been in tension with patent law. Patents secure property rights, which often appear superficially to be like the “monopolies” that the antitrust laws prohibit and punish. The type of monopolies that antitrust law is concerned with happen when there is only one or only a few producers of a common product; or when producers of common products use unfair and anti-competitive measures to secure a monopoly position in a market. If there are no competitors in the market, that singular producer can limit the supply of that product and then charge high prices; the producer has no incentive to make its product better or cheaper or easier to obtain because it is the only source.

The reason patents might look like these troublesome monopolies is that, if a patent owner has invented a new technology or product, such as Alexander Graham Bell’s invention of the telephone (secured by a patent in 1876), the inventor or patent owner can exclude others from using the patented product for the duration of the patent term, which was 17 years from the date of issue for Bell, or 20 years from the date of filing today. Although the exclusive rights of a patent may result in only one or a few producers of a product, it is not a monopoly because the inventor created that product and the associated market. The inventor did not usurp an existing market or take away anyone’s preexisting property rights—the patent only secures a new invention that leads to a completely new product or service. These products and services, and the associated new markets, arose solely by the laudable application of the inventor’s creative labors in bringing forth something entirely new to which the public did not have access before.

Patent rights are distinct from monopolies in several other important respects. First, a patent does not necessarily give the inventor the right to practice the invention, but instead only the right to exclude others from using the patented invention. No patent owner can stop a competitor from designing around a patent in coming up with a different invention that competes with the patented invention in the marketplace. Moreover, the patent right is of limited scope and duration. The patent covers only the specific invention claimed, and its term runs only from the issue date until its expiration date 20 years from the filing of the application. Upon expiration of the patent, anyone is free to make, use, and sell the invention. And, during the term of the patent, the public has access to the teachings of the patent to either improve upon the invention, or to use it to create non-infringing substitutes, which is known as “designing around” a patent. Thus, patents serve a valuable public purpose by encouraging inventors to disclose new ideas and products to the public in exchange for a time-limited, exclusive property right; and the public has the benefit of unrestricted use of those new ideas upon expiration of the patent.

The practice of conferring valuable exclusive rights for meritorious inventions has stimulated our nation’s creativity, nurtured industrial expansion, and fueled economic growth ever since passage of the first Patent Act of 1790. Antitrust law has not always recognized these differences between troublesome monopolies and the property rights granted by a patent. In the mid-1990s, it appeared that regulators would no longer look askance at patents as “monopolies,” and instead would treat them no differently than other types of property.6 In recent years, the tide has shifted again, and antitrust regulatory officials returned to a more hostile view of patents. They have aggressively increased regulatory scrutiny of patented innovation, especially for inventions that are made part of technological standards (known as “standard-essential patents” or SEPs), and for patent licensing more generally.

What gave rise to that shift in antitrust policy? It was largely driven by unconfirmed academic theories about why and how patent owners might license their patented technology in the marketplace. Based on theoretical predictions and anecdotes, regulators have actively inserted themselves into the development of technological standards and have started to exercise influence over the legal rules that guide licensing negotiations in the marketplace.7 The antitrust regulations are based on zero evidence of consumer harm or harm to innovation; worse, for an area of law that has regularly relied on robust economic analysis, no economic study has ever proven that a systemic problem exists in patent owners exercising their rights to impede innovation or hurt consumers.8 On theory alone, regulators have made things worse for innovators and the U.S. innovation economy. Through advocacy efforts, as well as official investigations and enforcement actions, antitrust regulators have undermined the incentives that stable and effective patent rights provide to innovators, which bodes ill for our standard of living, jobs, and economic growth in the future.

Though perhaps not immediately obvious, there is a fundamental connection between patent law and antitrust law. The relationship between a patent system that incentivizes new innovation by providing reliable and effective property rights in inventions is more obvious and well established. What many are unaware of is the inherent tension between patent law and antitrust law, and how antitrust law can be used to undermine innovation.

II. Technology Standards and Patent Licensing

Innovators in high-tech fields, including computers, mobile telephony, networking, automobiles, and appliances, depend on reliable and effective patent rights to protect the fruits of their creativity and productive efforts. Under the guise of the antitrust laws, government agencies like the Federal Trade Commission (FTC) are taking regulatory actions that undermine these very important patent rights, causing inventors and companies to reconsider their decisions to invest in innovation. While innovators face numerous hurdles in patenting inventions in the high-tech space, there are a few specific areas of commerce that are negatively affected by overzealous governmental interference: technological standards and patent licensing.9 To understand how the government is interfering in these two areas, it is important to first understand what technological standards are and why they are important, as well as the vital role that patent licensing plays in high-tech innovation.

A. Technological Standards & Why They Are Important

Consumers may not be aware of technological standards, but they are everywhere; and technology enabled by standards is found in almost everything we use. We are surrounded by standards where interoperability—devices and network speaking a common language with each other—is key: common household things, like electrical outlets in walls and the two- or three-prong plugs that fit into them, the lightbulb sockets in our lamps and ceilings that work with every type of lightbulb, and the USB ports on our computers in which any device can be plugged in. There is another category of standards which enable not only interoperability but facilitate companies from all over the world coming together to jointly innovate new technology solutions for brand new problems. Examples include 4G wireless cellular and 802.11 WiFi standards that make our smart phones “smart” and connect our laptops and devices anywhere. These are just two examples of the ubiquity of complex innovative technological standards. One reason standardized technology is everywhere is that it allows for a “universal” technology with consistent features and specifications, allowing the various products in our homes and offices to work with each other, regardless of what company manufactured any given product. While consumers have heard of the thousands upon thousands of companies that make products based on technological standards, such as General Electric, Nokia, Microsoft, Apple, and Disney, it is less likely they have heard of the organizations that develop the standards, known as “standard development organizations” (SDOs). These organizations, including ANSI, IEEE, and ETSI, may not be on the tip of every consumer’s tongue, but if one were to look, these organizations’ names would be found in the user manuals and compliance notices that come in the boxes with the new products we buy from retailers, especially if these products are electronics goods.10

SDOs are organizations that bring together representatives from different companies and even different industries to develop technology that achieves a particular goal or solves a problem in consumer goods, in manufacturing, or in commercial activities. Sometimes this goal is related to product quality or safety; other times, the goal is related to connectivity. An example of a quality and safety standard is the E-911 standard, a set of technological specifications for systems and processes enabling dispatchers to route emergency services regardless of whether a telephone call to the 911 system is made from a landline or cell phone. Connectivity standards provide specifications for systems and processes that ensure the products will connect and work with other products faster and more efficiently, no matter what company manufactured the product. For example, 4G LTE technology enables you to not just talk to your friends and family over a voice call, but to share pictures and videos, check your email, browse the internet, and stream videos in ways that were unimaginable to do wirelessly just a decade ago. In addition, regardless whether you are using an iPhone, a Samsung Galaxy, or an HTC smart phone, and regardless whether you are a customer of Verizon Wireless, AT&T, Sprint, or T-Mobile, standards ensure that you are able to use 4G to connect with friends and family around the world. These are just a few examples of tens of thousands of technological standards; they are found in nearly every aspect of everyday life.

Part of what makes technological standards so useful is that they represent the best innovative solutions for whatever goal is being addressed by the SDO. In the process of creating a standard, many companies spend many years and thousands of hours by engineers, investing billions of dollars, developing technology that may end up as part of a standard. Over the span of years at the SDO itself, representatives from companies making products all along the supply chain, as well as engineers and scientists, gather at meetings to review various technologies; and, based on an intensive and rigorous peer review that can take thousands of hours and many years, they ultimately select technological parameters to define as a “standard”, usually based on its technical merit and interoperability. An SDO can achieve what no single company would be able to, because it can take advantage of the intellectual and financial resources of the many participating companies and has a wide range of proposed technologies to review and choose from.

The flipside of this, however, is that companies that participate in SDOs are spending a lot of resources to participate—whether they themselves contribute technological innovations for review and incorporation, or whether they send engineers to participate in the review process. Because the patenting process often comes before the standards development process, and because many of those companies contributing to the standards development process are necessarily deeply immersed in innovative R&D to come up with new, innovative solutions, it is often the case that technologies submitted for inclusion in a technological standard are the subject of patent protection. However technology submitted for inclusion in a standard may or may not actually be included in the standard. One way that these companies can recoup their extensive R&D expenses, as well as the costs of participating in the SDO, is by obtaining patents on their innovative technology that may (or may not) be chosen for the technological standard.

Most SDOs permit companies that contribute to the development of a technological standard to have patents on technology submitted for inclusion in the standard. Without permitting innovators to protect the fruits of their labors by a property right in their new invention, there will be fewer inventions to include in future standards for new products and services in the marketplace. But how are we to ensure that patent owners don’t discriminate once their technological innovation is selected as a standard, arbitrarily picking winners and losers among the companies that have to use the standard?

SDOs long ago adopted a solution: patent owners contributing to a standard must agree that they will license their patents on technology included in a standard to all companies and users on “fair, reasonable, and non-discriminatory” (FRAND) terms. This way, all companies that wish to make products or offer services based on the technological standard will pay a reasonable price, and companies that submit patented technology to an SDO to be included in a standard can be ensured they will receive reasonable licensing fees when other companies use the technology they invested in and created.

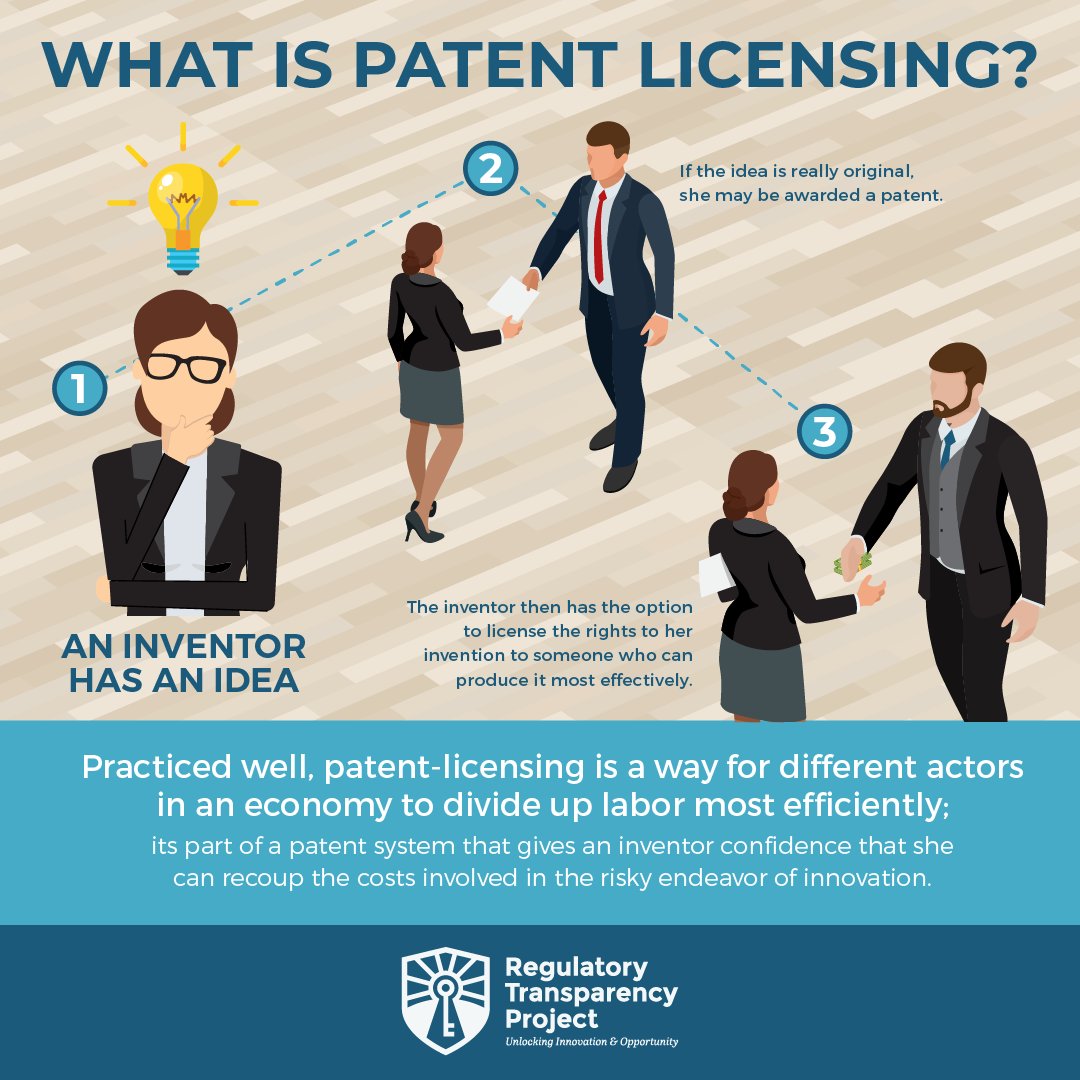

B. Patent Licensing and Why it is Important

As mentioned in the prior section, patent licensing is important when dealing with innovation covered by technological standards, because the patented technology is then licensed to any company that wants to incorporate the standardized technology into its goods and services. But patent licensing is critical for innovative technology even if standards are not involved. As economists have long recognized, the ability of patent owners to choose to engage in patent licensing has been a key part of the success of the innovation economy over the past 200 years. Patent owners can recoup some of the R&D expenses used to develop their new technology either by making and selling the innovative product themselves, or they can obtain licensing fees by allowing other companies to make and sell the product. In either case, inventors get paid to do more inventing, and the public gets an ongoing stream of new and innovative products.

Patent licensing allows different people and different companies to specialize, or to do whatever tasks they are best suited for, while helping to get innovative products to consumers. Economists call this focusing on one’s “comparative advantage,” a principle long recognized (since Adam Smith) to be optimal for everyone. Some people are good at cooking food or selling their wares, while others are good at running a business, writing books, flying airplanes, or more. When it comes to innovation, some people are good at inventing or dreaming up new ideas, while others are good at manufacturing, distributing to retailers, advertising, or selling to consumers. Patent licensing has made it possible for inventors to focus on creating new innovations, while permitting businesspeople to develop, manufacture, and ultimately sell their products and services to consumers. This idea that some people are good at inventing while others are better at implementing, manufacturing, or selling those inventions is not a new one. Charles Goodyear, for instance, was a classic “crazy inventor” who let others commercially develop his radical new process for curing rubber. Thomas Edison was at first successful in licensing his patents to fund his inventive activities; when he later tried to manufacture and sell his inventions himself, he lost millions of dollars in the process.11 As Henry Ford famously said of Edison, “He’s the world’s greatest inventor, and the world’s worst businessman.”12

Patent licensing not only permits specialization in the marketplace, it also makes it possible for companies to create technology that is ultimately adopted by other companies in technological standards created by SDOs. The fact that standardized technology can be licensed makes the goods and services that incorporate the standard more valuable. Especially for standards that focus on interoperability, as many do in the high-tech sector, the more consumers that are using a certain technology, the more value it has due to positive “network effects”. And the more consumers that use a certain technology, the more manufacturers are going to want to make and sell products incorporating that technology. Patent licensing, by allowing a variety of manufacturers to incorporate a standardized technology into their products, has a positive impact in the form of network effects.

Patent licensing not only permits specialization in the marketplace, it also makes it possible for companies to create technology that is ultimately adopted by other companies in technological standards created by SDOs. The fact that standardized technology can be licensed makes the goods and services that incorporate the standard more valuable.

Receive more great content like this

III. FTC Interference with Technology Standards and Patent Licensing

The regulatory interference with SDOs and technological standards, as well as with patent licensing more generally, is based in antitrust law. Regulatory authorities at the FTC have sometimes engaged in heavy-handed regulatory review of patent owners who license through SDOs or in the marketplace.13 In these cases, the government is (1) relying on unproven theories and unsupported anecdotes that have been promulgated by “technology users” to meddle with the rights of patent owners who participate in SDOs, (2) attacking patent licensing more generally, in part by invoking a mythological creature—the “patent troll”—which at best is a problem on the fringes of the patent system, and (3) picking winners and losers, favoring some companies or organizations that happen to have the power or access to receive it. This interference in the U.S. innovation economy risks eliminating the incentives to invent that patent rights have long provided the inventors who drive economic growth and elevate our standard of living.

A. Antitrust, SSOs, and “Patent Hold Up”

In recent years, antitrust regulators have been taking a closer look at SDOs and innovative companies that participate in SDOs based on one-sided, unbalanced theories that these companies are engaging in “bad” behavior, made possible by the standardization of technology. The most common of these theories that regulators have relied on are called “patent hold up” and “royalty stacking.” Although regulators use these theories to justify intervention in the free market, there is scant evidence that either patent hold up or royalty stacking are systemic problems, and no evidence that, even if these practices do exist, they present real and substantial harm to innovation or to consumers.

Patent hold up is the idea that the owner of a patent covering technology incorporated in a standard could “hold up” anyone seeking to implement the standard by demanding inordinately high royalty rates (what economists would call “supra-competitive rates”). In other words, the incorporation of the patented technology into the standard would enable the owner of the “standard-essential patent” (SEP) to use the standard itself as leverage in demanding an unreasonable licensing fee from the manufacturers (and consumers) who must use the standard if they wish to sell and buy products incorporating it, such as the 4G communication standard in smartphones. For some odd reason, although the theory is borrowed from the classic “hold up” theory from the economic analysis of contracts, for a long time there was no mention of how this could be a two-sided problem; that is, implementers of technological standards could refuse to pay the reasonable compensation after using the patented technology by simply making smartphones or other products given the knowledge of the technology that is available to all via the patent and the SDO’s publications of the standard—a problem that is referred to as “hold out.”14

The first problem with the “patent hold up” theory is that it fails to consider the property rights that are secured by a patent. Just as a real property owner could conceivably stop anyone from using his property by telling a trespasser to “get off of my land,” a patent owner has the same right to tell an infringer to stop using the technology secured by its patent. The inclusion of a patented technology into a standard does alter these circumstances; for the success of the standard and to reap the benefits of network effects, it is important to ensure that every company that wishes to use the standard has access to the standard. SDOs require participating companies to agree to license any SEPs on a FRAND basis, ensuring equal treatment of all users of the standard in paying a reasonable fee to use the patented technology. At the same time, SDOs recognize that the patent owner is entitled to receive adequate compensation in the form of licensing fees for recovering their risky R&D costs. Maintaining a balance between the incentives of implementers and innovators is critical for SDOs, as their success depends upon being able to attract both types of companies as voluntary members for developing common standards.

Royalty stacking is a related theory that suggests that to license all of the necessary patents to practice a standard (or otherwise manufacture a product having multiple components covered by multiple patents from many patent owners), the patent owners will demand license fees that cumulatively will greatly diminish or even outpace the profit the manufacturer can obtain from sale of the product. Essentially, the required royalty fees stack up, causing the manufacturer to either raise the price of the product to cover the fees, or stop making the product altogether. Oftentimes, the royalty stacking theory is also laced with notions that it is the patent owners, engaging in “patent hold up”, to charge excessive fees, that cause royalty stacking; however, even without portraying the patent owners as villains, the theory still has a certain logic to it. In reality, though, the royalty stacking theory simply doesn’t hold true. If royalty stacking were an actual problem, we would not be enjoying any sort of high-tech goods today—because many of these products include multiple patented technologies from multiple patent owners. And yet, we have cars, computers, smart appliances, and smartphones, all of which are products in industries that are based on thousands of products and services secured by patents; and ours is, arguably, the most vibrant and dynamic high-tech industry in the world.15

Based on these two purely theoretical concerns, the FTC has pushed heavily for regulatory restrictions on patent licensing rights in the SDO context. For example, some regulators have demanded that patent owners relinquish their rights to seek injunctions against infringers of their patents, and they have actively inserted themselves into the details of licensing negotiations. Both of these aspects of a functioning free market and growing innovation economy—the legal right to stop someone who is found liable for violating one’s property rights and private-party contract negotiations between sophisticated commercial companies—are activities that have functioned well for many decades under the Patent Act and with courts as enforcers, without any additional meddling from the government. Not only is the FTC stepping in to “fix” something that is not broken, it is doing so without any evidence of consumer harm or impediments to innovation. In fact, the exact opposite has been observed—the patent-intensive smart phone industry has experienced the largest quality-adjusted price drops, new products and services, and market expansion compared to other non-patent-intensive industries.16 Competition and innovation are both flourishing in this industry without the government’s regulatory “assistance.”

Worse still, the government is not content to simply meddle in the private negotiations between a patent owner and a manufacturer, or in the civil lawsuits between a patent owner and an infringer. Antitrust regulators have also used the theoretical problems of “patent hold up” and “royalty stacking” to actively influence SDOs to alter their own patent policies. For example, the IEEE, an organization that oversees thousands of standards in hundreds of technologies, recently revised its patent policy. The policy, among other things, takes away the right of a patent owner who participates in its development of technological standards to seek an injunction against anyone who is infringing its SEP, turning the FRAND commitment into a compulsory license—making these patents less valuable than patents in other industries.

The problem with these changes by SDOs is that this is a dangerous short-term game being played by users of technological standards, because they are changing the rules of the game after the sunk cost R&D investments have been made by the innovators. In the long run, such policy revisions make it less appealing for a company to invest in developing new, innovative technology and to participate in SDO activities. If companies decline to participate in SDOs because of these policy revisions, there will be fewer technologies contributed to the SDO for consideration and less robust participation by these companies’ engineers. Having the best ideas and the smartest people at the table when a standard is being developed is a key strength of standardization, and this will disappear if innovative companies begin to eschew participating in SDOs.17 At the end of the day, if participation in an SDO is unattractive to innovative companies due to the SDOs patent policies, innovation will suffer. As companies refocus their innovative efforts towards proprietary technologies instead of creating common standards. This will hurt competition and consumers, the very people antitrust regulators are supposed to be protecting.

The problems with the “patent hold up” and “royalty stacking” theories are biased without taking into account other factors that drive the functioning of a market, such as long-term incentives of technology developers and licensors to make the industry successful and maximize demand for their technology, thus keeping any price increases under check. There is no evidence to support these theories, and the harms alleged by these theories are simply not borne out. Proving that these harms are not real is as easy as asking you to take your smart phone out of your pocket or your purse. And yet, despite this very tangible evidence that the high-tech world is functioning well in the presence of SSOs and standardized technologies, the antitrust regulators are pushing forward on thin air. Separately, the potential of hold out, which enables technology users to reduce the price of the technology, or stop paying for it altogether, may become a rational strategy when injunctions are hard to obtain and restricted to even seek.

The starkest example of lack of evidence of “patent hold up” was revealed at a conference in Washington, D.C. in 2015, when the chief antitrust official at the Department of Justice under the Obama Administration was asked if there was any evidence that supported her aggressive enforcement tactics to punish “patent hold up” and “royalty stacking” behaviors in the marketplace. She replied that unnamed companies had told her in meetings that they had experienced “patent hold up”—unidentified companies with the political access and economic wherewithal to seek and receive confidential, closed-door meetings with federal regulatory officials. It was on the basis of these meetings with companies whom she refused to identify that she thought it was necessary to take regulatory actions that affect all innovators throughout the entire high-tech innovation economy. She further defended her actions by saying that peer-reviewed economic studies and other evidence of consumer harm in the marketplace were ultimately unnecessary, as she felt it sufficient that she should do “what is right in [my] heart.” Thus, a top regulatory official with the power of the federal government’s antitrust laws and regulations at her disposal felt no compunction against admitting that unproven academic theories, secret meetings, and the feelings of her heart were all valid sources of her taking actions that affected the R&D investments and intricate commercial dealings in the innovation economy that make possible our miracle technology today.

B. Antitrust, Patent Licensing, and “Patent Trolls”

Even when patents covering technological standards are not implicated, antitrust regulators have been taking aim at patent licensing more generally. This time, the threat is not “patent hold up,” but so-called “patent trolls.” A “patent troll” is a euphemism that has come to embrace virtually any person or company that profits from its patents other than by directly manufacturing a product. This includes companies that license their patented technology to other companies, such as IBM, Nokia, Dolby, 3M and others that follow in the footsteps of Thomas Edison, Nikola Tesla, and Charles Goodyear. Some do not manufacture anything, while others do. Some invented the technology they now own, while others purchased their patents from individual inventors, other companies, or even failing or failed businesses. Indeed, advocates of the patent troll myth have gone so far as to suggest that America’s universities, wellsprings of innovation in both groundbreaking technologies and medical care,18 are patent trolls simply because they invent, they patent, they license, and they sue infringers, but they don’t actually manufacture products in factories.19

In a speech on October 18, 2018, Andrei Iancu, Director of the U.S. Patent and Trademark Office, criticized the “patent troll” rhetoric as both a myth and as a message that undermines innovation:

The goal of this narrative is the same as that of stories such as Little Red Riding Hood: don’t leave the village. Don’t take risks. Stay in your lane! Because if you do take risks, if you do have the gall to get out of your lane, you may encounter big bad wolves or other scary monsters. And horror of horrors, you may encounter “patent trolls!”

What an odd message to deliver in the 21st century. What an odd message to deliver in America in particular, a country of risk-takers, entrepreneurs and inventors. An odd message indeed, especially given the incredible success of the American patent system over time.20

Director Iancu is right. Regardless of their business model or mode of operation, any person or commercial enterprise that licenses its patents serves a valuable economic function—they are the “economic intermediaries” that connect owners with buyers, just as car dealerships, stock brokers, eBay, and Amazon do for other goods and services.

There is nothing wrong with profiting from innovation by licensing patents to others. As noted, this is a key feature of a flourishing free market, it promotes economic efficiencies through specialization, and it has been an economically significant feature of the U.S. patent system from its inception in 1790. The Supreme Court has recognized that many people and organizations, including inventors and universities, have legitimate economic reasons for licensing their patented innovations.21 Patent licensing allows companies to focus on their areas of expertise, whether it be invention, manufacturing, sales, or otherwise; and it allows innovative firms to recoup R&D expenditures to continue their inventive activities.

Yet, according to antitrust regulators, if a company that licenses its patents is forced to sue an infringer, or merely threatens to sue a recalcitrant company that is holding out in negotiations and refusing a license while infringing a patent, this could constitute anti-competitive behavior and thus violate antitrust laws. The concern is a generalized claim that consumers are harmed somehow when a patent owner asserts its rights against the unauthorized use of its property by another company for its own profit. What economic evidence is driving these investigations and threats by antitrust regulators? Just as with the unproven theories and anecdotes about standard-essential patents (SEPs), there is none. Even worse, and indicative of the Kafkaesque nature of this regulatory overreach, when manufacturers do the exact same thing in suing to protect their property rights in their patents, this is barely worthy of comment by antitrust regulators. What is the difference between the two? One patent owner licenses its property, and the other uses its property to manufacture or sell goods to consumers. There is no economic study that justifies this different legal treatment by antitrust regulators, nor is there any antitrust law or regulation that explains it either.

To be sure, there are a few “bad actors” among patent owners—those who have gone beyond simply enforcing patent rights and engaged in fraud, unfair competition, or improper litigation practices. One prominent example, and one of the few actual examples frequently cited in discussions of “patent trolls,” is MPHJ, which sent deceptive letters to thousands of businesses falsely asserting that it owned a valid patent that the companies were allegedly infringing and demanding payment of a royalty. MPHJ was rightly sanctioned for its bad behavior, and that was the end of it.22

More important, though, is that bad behavior like the fraud committed by MPHJ is not limited to any particular business model. Large companies that make, distribute, and sell their own patented products can behave badly. In short, it does not matter what the business model is, what matters is the conduct of the party seeking to enforce its rights. Is it doing so in an ethical, prudent, and responsible fashion, or is it engaged in a strategic game of legal “gotcha”? A patent owner that licenses its property rights and a manufacturer can each engage in the same legally proper or legally improper behavior. The myopic focus of antitrust regulators on patent owners based on their business models rather than their specific behaviors simply make no sense, either economically or legally.

Unfortunately, the FTC wasted an opportunity to better understand and explain this distinction between business models and abusive behaviors when it began a multi-year study of the issue. For an agency that prides itself on economic analysis and research, the FTC’s 2015 study on “patent assertion entities” (an allegedly more neutral term for “patent trolls”) was deeply flawed.23 The FTC’s report “Patent Assertion Entity Activity: An FTC Study” looked at non-public information and data from 2009 to 2014 using the FTC’s Section 6(b) subpoena powers. With this capability, the FTC could have explored and exposed much of what is not yet understood about patent licensing. However, the study was flawed from the beginning because the FTC narrowly defined the category of businesses it would study, specifically limiting its definition of PAEs to businesses that acquire patents from third parties and seek to generate revenue by asserting them against alleged infringers. Because of this narrow definition and the extremely limited data this set of patent licensing firms returned, the FTC concluded that there were only two types of patent licensing companies (big and good, or tiny and bad) and the smaller-sized patent licensing companies were a significant source of nuisance litigation. What was neglected were the myriad of reasons, business models, and behaviors employed by patent licensing companies.24 Any policy recommendations that spring from the FTC’s 2015 report are without support; in fact, the reform proposals that the FTC included in the report were unrelated to the data in the report. They were simply more proposals based on the same academic theories and unverified anecdotes that have dominated the extensive antitrust scrutiny of SEPs in technological standards.

The FTC’s campaign against “patent trolls” or “patent assertion entities” confirms that antitrust regulators have been swept up in a massive lobbying and PR campaign over the past decade. Millions of dollars have been spent in Washington, D.C. to convince Congress, judges, and regulators that “patent trolls” are a menace to society. Similar to the concerns about access, the companies that benefit most from this campaign are the ones who have had significant access to government officials. One of the primary proponents of the “patent troll” narrative in D.C. has been Google,25 whose lobbyists met with President Obama hundreds of times during his presidency, more than any other company.26 Perhaps unsurprisingly, President Obama ordered regulatory attacks on patent trolls,27 and he called for Conges to enact legislation to target patent trolls in a Google Chat he participated in in 2013.28 This is not the evidence-based, neutral policy-making that we should expect from elected officials or by regulators, such as the antitrust officials at the FTC.

More important, though, is that bad behavior like the fraud committed by MPHJ is not limited to any particular business model. Large companies that make, distribute, and sell their own patented products can behave badly. In short, it does not matter what the business model is, what matters is the conduct of the party seeking to enforce its rights. Is it doing so in an ethical, prudent, and responsible fashion, or is it engaged in a strategic game of legal “gotcha”? A patent owner that licenses its property rights and a manufacturer can each engage in the same legally proper or legally improper behavior.

Conclusion

Antitrust regulators devote themselves to investigating, identifying and discouraging behaviors that harm consumers in the marketplace. They are supposed to use information and data to inform and guide their enforcement actions against these bad actors. As with all laws, this ensures a just and level playing field, open markets, and robust economies. Regulators should be careful, however, not to overstep, and in so doing pick winners and losers in the marketplace on the basis of broad-brushed condemnations of business models, whether these are manufacturers, wholesalers, retailers, or any other marketplace actor that produces, licenses, or sells products or services to its customers.

Patent licensing is a commercial practice that has been used for hundreds of years in the free market, promoting efficiency by fostering specialization between different commercial actors in the marketplace. This has brought products to consumers faster and at lower prices. As with any other property owner or commercial enterprise, particular bad actors can exploit patent licensing to violate the laws and harm business partners and customers. The government rightly investigates these acts and punishes them accordingly. But this says nothing about the general business model of patent licensing, and whether it is proper for a patent owner to choose between being a manufacturer or pursuing further invention through R&D and profiting from its patents on these inventions through licensing. These are proper business models that are laudable for advancing innovation, growing the economy and creating a flourishing society. Branding one business model as worthy and another as suspect is unjustified and dangerous, because it replaces marketplace decisions with regulatory dictates based on assertions of what sounds “right” to a government official.

The United States has long been a country of inventors and entrepreneurs, and it has led the world in innovation for two hundred years. This inventive spirit is not in hardwired in the DNA of American citizens; instead, it is fostered by our laws. In democratizing the patent system by securing property rights in the fruits of the inventive labors of all people from all walks of life, the U.S. Constitution authorizes Congress to “to promote the progress of science and useful arts.” If we reduce those incentives to innovate, we will lag behind other countries, just as England, the birthplace of the Industrial Revolution in the eighteenth century, fell behind the U.S. in the nineteenth century in promoting new innovation. Law is a powerful teacher and profit a powerful motivator.

If regulators increasingly send the message to inventors that their inventions are suspect, even after receiving a patent, and if investors conclude that profits are deemed less likely because of weakened patent protections, the mantle of world leader in technological innovation may very well pass to another country that provides more reliable and effective legal protections in the patents it issues to its innovators. Regulatory overreach by the FTC in key sectors of the U.S. innovation economy—in the patents covering technological standards and in patent licensing generally—can become an important factor in snuffing out Americans’ spirit of invention.

Footnotes

1 James Madison, The Federalist No. 43 (“The copy right of authors has been solemnly adjudged in Great Britain to be a right at common law. The right to useful inventions seems with equal reason to belong to the inventors. The public good fully coincides in both cases, with the claims of individuals.”).

2 See Global Innovation Policy Center, International IP Index (2018) https://www.theglobalipcenter.com/wp-content/uploads/2018/02/GIPC_IP_Index_2018.pdf

3 See Charles Duhigg & Keith Bradsher, How the U.S. Lost Out on iPhone Work, New York Times, Jan. 21, 2012, at https://nyti.ms/2q7W42r. See also Designed in California, made in China: How the iPhone Skews U.S. Trade Deficit, Reuters (Mar. 21, 2018), https://www.reuters.com/article/us-usa-trade-china-apple/designed-in-california-made-in-china-how-the-iphone-skews-u-s-trade-deficit-idUSKBN1GX1GZ

4 See Adam Mossoff, Patent Licensing and Secondary Markets in the Nineteenth Century, George Mason Law Review, vol. 22 (2014), pp. 959-971, https://ssrn.com/abstract=2602902

5 See Stephen Haber, Patents and the Wealth of Nations, George Mason Law Review, vol. 23 (2016), pp. 811-835, https://ssrn.com/abstract=2776773

6 See U.S. Dep’t of Justice & FTC, Antitrust Guidelines for the Licensing of Intellectual Property (Apr. 6, 1995), available at https://www.justice.gov/sites/default/files/atr/legacy/2006/04/27/0558.pdf

7 See Alexander Galetovic & Stephen Haber, The Fallacies of Patent Hold up Theory, Journal of Competition Law & Economics, vol. 13 (2017), pp. 1-44, https://academic.oup.com/jcle/article/13/1/1/3060409

8 See Letter to Assistant Attorney General Makan Delrahim, Feb. 13, 2018, at https://cpip.gmu.edu/wpcontent/uploads/sites/31/2018/02/Letter-to-DOJ-Supporting-Evidence-Based-Approach-to-Antitrust-Enforcement-of-IP.pdf (“It bears emphasizing that no empirical study has demonstrated that a patent-owner’s request for injunctive relief after a finding of a defendant’s infringement of its property rights has ever resulted either in consumer harm or in slowing down the pace of technological innovation.”).

9 Some of the issues related to patent licensing are present or exacerbated by technology standards; however, there are certainly concerns about government overreach regarding patent licensing in the absence of technology standards.

10 Sometimes the standard’s name does become a household phrase. For one example, consider the Universal Serial Bus standard, well known to most people because we regularly use our USB ports on our electronic devices.

11 See Mossoff, Patent Licensing and Secondary Markets, supra note 4

12 Randall Stross, The Wizard of Menlo Park: How Thomas Alva Edison Invented the Modern World (Broadway Books, 2007), p. 165.

13 See, for example, Federal Trade Commission, The Evolving IP Marketplace (March 2011), https://www.ftc.gov/sites/default/files/documents/reports/evolving-ip-marketplace-aligning-patent-notice-and-remedies-competition-report-federal-trade/110307patentreport.pdf

14 See Makan Delrahim, Remarks at the USC Gould School of Law’s Center for Transnational Law and Business Conference (Nov. 10, 2017), https://www.justice.gov/opa/speech/assistant-attorney-general-makan-delrahim-delivers-remarks-usc-gould-school-laws-center (“Too often lost in the debate over the hold-up problem is recognition of a more serious risk: the hold-out problem. . . . I view the collective hold-out problem as a more serious impediment to innovation. Here is why: most importantly, the hold-up and hold-out problems are not symmetric. What do I mean by that? It is important to recognize that innovators make an investment before they know whether that investment will ever pay off. If the implementers hold out, the innovator has no recourse, even if the innovation is successful. In contrast, the implementer has some buffer against the risk of hold-up because at least some of its investments occur after royalty rates for new technology could have been determined. Because this asymmetry exists, under-investment by the innovator should be of greater concern than under-investment by the implementer.”).

15 See Alexander Galetovic, Stephen Haber, & Ross Levine, An Empirical Examination of Patent Hold Up, Journal of Comparative Law & Economics, vol. 11 (2015), https://academic.oup.com/jcle/article/11/3/549/800066

16 See id.

17 See Ron Katznelson, The IEEE Controversial Policy on Standard Essential Patents – The Empirical Record Since Adoption (2018).

18 See 100 Important Innovations That Came From University Research (Aug. 27, 2012), https://www.

19 See Peter Leung, Darrell Issa: Universities Act as Trolls Too, Managing Intellectual Property (March 24, 2015), http://www.managingip.com/Article/3439383/Darrell-Issa-Universities-act-as-trolls-too.html

20 Remarks by Director Iancu at the Eastern District of Texas Bar Association Inaugural Texas Dinner, October 18, 2018, https://www.uspto.gov/about-us/news-updates/remarks-director-iancu-eastern-district-texas-bar-association-inaugural-texas

21 See eBay Inc. v. MercExchange, LLC, 547 U.S. 388, 393 (2006).

22 Edward Wyatt, F.T.C. Settles First Case, Targeting “Patent Troll,” New York Times (Nov. 6, 2014), https://www.nytimes.com/2014/11/07/business/ftc-settles-first-case-targeting-patent-troll.html

23 See Kristen Osenga, Sticks and Stones: How the FTC’s Name-Calling Misses the Complexity of Licensing-Based Business Models, George Mason Law Review, vol. 22 (2015), https://ssrn.com/abstract=2834140

24 Id.

25 See Tony Romm & Erin Mershon, Big Tech all over D.C. patent war, Politico (April 27, 2014), https://www.politico.com/story/2014/04/big-tech-tracks-are-all-over-dc-patent-war-106076

26 See Mario Trujillo, Report finds hundreds of meetings between White House and Google, The Hill (April 22, 2016), https://thehill.com/policy/technology/277251-report-highlights-hundreds-of-meetings-between-white-house-and-google (“Google and its affiliates have had at least 427 meetings at the White House during President Obama’s tenure . . . .”).

27 See Edward Wyatt, Obama Orders Regulators to Root Out ‘Patent Trolls,’ New York Times (June 4, 2013), https://www.nytimes.com/2013/06/05/business/president-moves-to-curb-patent-suits.html

28 See Erin Fuchs, Obama Calls Patent Trolls ExtortionistsWho Hijack People’s Ideas, Business Insider (Feb.15, 2013), https://www.businessinsider.com/obamas-patent-comments-at-google-chat-2013-2